Tax Form For 401K Covid Withdrawal . if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options.

from www.dochub.com

this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,.

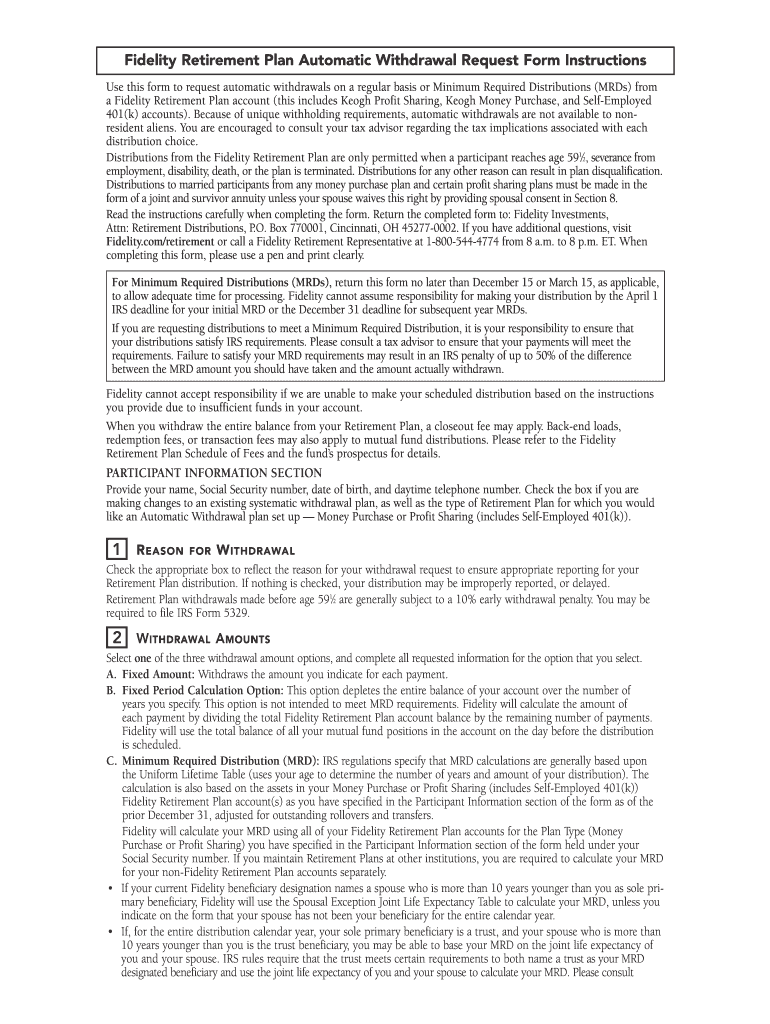

Fidelity 401k terms of withdrawal Fill out & sign online DocHub

Tax Form For 401K Covid Withdrawal If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year.

From www.thebalance.com

401(k) Hardship Withdrawals—Here's How They Work Tax Form For 401K Covid Withdrawal If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if. Tax Form For 401K Covid Withdrawal.

From www.dochub.com

Fidelity 401k terms of withdrawal Fill out & sign online DocHub Tax Form For 401K Covid Withdrawal this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of. Tax Form For 401K Covid Withdrawal.

From www.nj.com

Taxes on 401(k) withdrawals and contributions Tax Form For 401K Covid Withdrawal you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. If you were a qualified individual (see below) and. Tax Form For 401K Covid Withdrawal.

From www.signnow.com

John Hancock 401k Withdrawal Online 20122024 Form Fill Out and Sign Tax Form For 401K Covid Withdrawal this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. if. Tax Form For 401K Covid Withdrawal.

From www.dochub.com

Adp 401k withdrawal Fill out & sign online DocHub Tax Form For 401K Covid Withdrawal if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. you received a qualified. Tax Form For 401K Covid Withdrawal.

From www.forbes.com

How COVID19 Has Changed Retirement Planning Tax Form For 401K Covid Withdrawal you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. if you withdrew money from your 401(k) or ira for reasons related to. Tax Form For 401K Covid Withdrawal.

From www.ramseysolutions.com

401(k) Early Withdrawals Everything You Need to Know Ramsey Tax Form For 401K Covid Withdrawal you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. If you were a qualified individual (see below) and you withdrew money from your. Tax Form For 401K Covid Withdrawal.

From thefinancebuff.com

Form 5500EZ For Your Solo 401k Tax Form For 401K Covid Withdrawal if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. you received a qualified. Tax Form For 401K Covid Withdrawal.

From www.dochub.com

Cares act 401k withdrawal deadline 2022 Fill out & sign online DocHub Tax Form For 401K Covid Withdrawal you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. if. Tax Form For 401K Covid Withdrawal.

From www.dochub.com

Paychex 401k withdrawal form Fill out & sign online DocHub Tax Form For 401K Covid Withdrawal if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. you received a qualified 2022 disaster distribution from your 401(k) plan. Tax Form For 401K Covid Withdrawal.

From www.wsj.com

Everything You Need to Know About Required 401(k) and IRA Withdrawals WSJ Tax Form For 401K Covid Withdrawal If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if. Tax Form For 401K Covid Withdrawal.

From www.msn.com

401(k) Withdrawals Made Simple What Age Can You Go TaxFree? Tax Form For 401K Covid Withdrawal If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least. Tax Form For 401K Covid Withdrawal.

From www.signnow.com

Adp 401k Withdrawal Form Editable template airSlate SignNow Tax Form For 401K Covid Withdrawal if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. If you were a qualified individual (see below) and you withdrew. Tax Form For 401K Covid Withdrawal.

From www.dochub.com

Principal 401k withdrawal Fill out & sign online DocHub Tax Form For 401K Covid Withdrawal if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. if you already filed your 2020 tax return, you can claim. Tax Form For 401K Covid Withdrawal.

From www.dochub.com

Paychex 401k withdrawal Fill out & sign online DocHub Tax Form For 401K Covid Withdrawal this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at. Tax Form For 401K Covid Withdrawal.

From www.signnow.com

Voya Termination Withdrawal 20142024 Form Fill Out and Sign Tax Form For 401K Covid Withdrawal you received a qualified 2022 disaster distribution from your 401(k) plan in the amount of $15,000 on april 29, 2023. If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least. Tax Form For 401K Covid Withdrawal.

From www.the-sun.com

Covid 401k withdrawal 2021 what you need to know The US Sun Tax Form For 401K Covid Withdrawal if you already filed your 2020 tax return, you can claim a repayment made in 2022 as a deduction in a previous tax year. this relief provides favorable tax treatment for certain withdrawals from retirement plans and iras, including expanded loan options. if you withdrew money from your 401(k) or ira for reasons related to covid, you're. Tax Form For 401K Covid Withdrawal.

From www.the-sun.com

Covid 401k withdrawal 2021 what you need to know The US Sun Tax Form For 401K Covid Withdrawal If you were a qualified individual (see below) and you withdrew money from your 401(k), 403(b), or ira,. if you withdrew money from your 401(k) or ira for reasons related to covid, you're required to include at least a portion of taxes due on your 2020 return. you received a qualified 2022 disaster distribution from your 401(k) plan. Tax Form For 401K Covid Withdrawal.